Finance Minister Pravin Gordhan revealed a proposal to change legislation governing retirement fund contributions in the 2012 Budget. Recently, this proposal was at the centre of confusion and concern amongst taxpayers, when certain commentators incorrectly suggested that the new legislation would be effective from 1 March 2013.

If legislated, the proposed changes will only become effective from 1 March 2014 and have a significant impact on employers and taxpayers alike.

The current position

There are currently three types of retirement saving vehicles available to South African taxpayers – pension, provident, and retirement annuity funds. Each of these has separate tax dispensations for the treatment of contributions to, and benefits received from the funds.

Provident funds

- Employer contributions are not considered fringe benefits and therefore not taxed in the hands of the employee.

- An employee’s contributions to a provident fund are not allowable as a deduction against taxable income. However, the contributions are carried forward and are deductible against the lumpsum received on retirement from the fund.

Pension funds

- Employer contributions are not considered fringe benefits and therefore not taxed in the hands of the employee.

- An employee can however claim a deduction for contributions to an approved pension fund, limited to a maximum of the greater of 7.5% of their retirement funding employment income*, or R 1 750.

* Retirement funding employment income is essentially an employee’s cash salary, excluding travel allowances and bonuses, as well as other non-employment income such as interest (net of the exemption), annuities, etc. Further, any portion of the employee’s salary that is not taken into account in calculating contributions made by him, or on his behalf, to a pension or provident fund is excluded.

Retirement annuities

- Contributions by an employer to a retirement annuity are currently considered fringe benefits in the hands of employees.

- An employee may claim a deduction in respect of contributions to a retirement annuity fund limited to the greater of:

- 15% of his non-retirement funding employment income*;

- R 3 500 less his current contributions to his pension fund; and

- R 1 750

- Any portion of the contribution that is not deductible is carried forward and will be available for deduction against future non-retirement funding employment income and/or the lumpsum payable on retirement from the fund.

In the case of contributions to a pension fund and/or retirement annuity fund, there is opportunity to make an additional “top-up payment” to such fund before the end of February to get the maximum tax benefit, if the rules of the fund allows for this.

If this is possible, it means that, at the maximum marginal tax rate, a taxpayer will get an additional tax deduction of 40% of the top-up contributions made, which means that the fiscus is effectively financing 40% of such contributions.

Proposed changes

A recent discussion document released by Treasury indicated that the current regime governing deductions of retirement fund contributions is considered unsatisfactory for the following reasons:

- The complexities and undue administrative burden involved in tracking the deductibility of contributions;

- A perceived unfair advantage gained by high income earners arising from the absence of a monetary cap on the tax deductions available to them.

The following changes were therefore proposed to simplify and balance thetreatment of retirement fund contributions:

It appears that all contributions by employers to the three types of retirement funds will be treated as a fringe benefit, taxed in the hands of employees, subject to, inter alia, the allowances below:

- Employees will be granted a deduction of employer and employee contributions to all types of retirement funds of up to 22.5% (or 27.5% for those aged 45 and above) of the higher of employment income or taxable income, with a maximum deduction of R250 000 p.a. (R300 000 p.a. for those aged 45 and above). It appears that employment income will essentially mean “cost to company” and will include employer’s contributions to any funds on behalf of employees.

- Non-deductible contributions in excess of the above thresholds will be exempt from income tax if, on retirement, they are taken as part of a lump sum or as annuity income.

- A rollover dispensation, that is similar to the current retirement annuity fund contributions dispensation, will be adopted to cater for flexibility in contributions for those with fluctuating income.

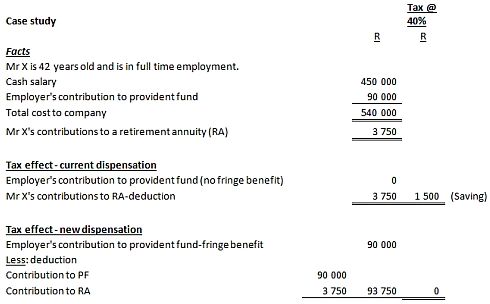

Below is an example of the potential effects on a taxpayer.

Note:

The deduction of R 93 750 is less than the maximum deduction allowable (22.5% of R 540 000 = R 121 500). However the deduction exceeds the fringe benefit and the excess of R 3 750 will be carried forward and will be available for deduction on retirement.

This new tax regime is yet to be legislated but theproposed implementation date is 1 March 2014.